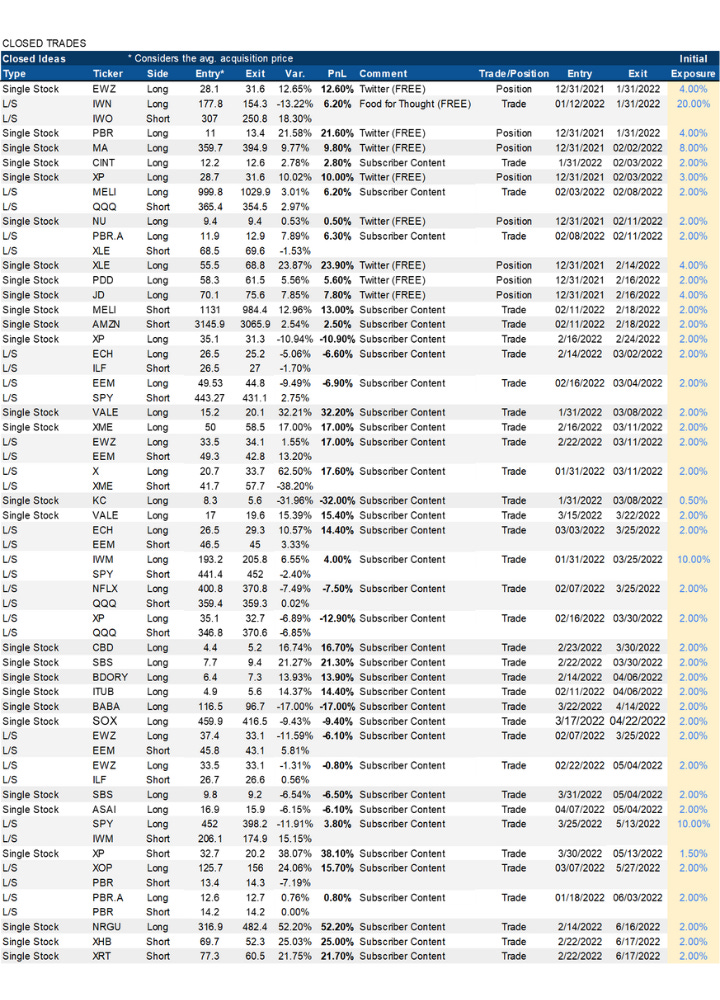

YTD Track Record

Short-Term Insights

From Previous Weeks

[Keep, May 2nd] I’m getting increasingly bull on Oil at the current prices. There is only a marginal sign of demand destruction, even though supply constraints have increased. We mentioned it in aFood for Thought edition, but releasing SPR inventory is stupid and non-sense. So instead, we proposed an alternative solution that would require support from the current administration. Unfortunately, our base case is that the current administration will let the market balance on demand destruction and, therefore, manufacturing job losses.Bull, XLE @76.35 (+16.2%)[Keep, May 9th] Although I’m still tactically bearish on tech stocks, we anticipated most of MercadoLibre’s extraordinary earnings and added heavily to our position. So in relative terms, Meli should outperform tech stocks. In my personal account, however, the leverage is low.

Bull Ratio MELI / XLK @6.60 (-20.1%)[Keep, May 9th]Bull RRRP3 @44.00 (1.3%):I wanna keep it simple. I’m long RRRP, but not paying attention to EWZ anymore.[Keep, May 22nd] We wrote about this trade in this Food for Thought edition, but it sounds good owning cyclical stocks vs. defensive. Since I found no ETF that matched the basked I used to trade, the closest one was the Value ETF (IWN). On the short side, a consumer staple is a straightforward call. So, the final trade is long IWN and short KXI. Sizing on this one was a bit tricky. On fundamental, the upside looks limited, though the technical sucks. However, we believe this earnings season may prove a catalyst for the trade, so we decided on a 10% exposure with an 8% stop loss.

Bull Ratio IWN/KXI @2.48 (-1.6%)

Weekly Comments

The market is telling us to wait

Since last week, we’ve seen a solid price action in energy stocks, triggering a brutal stop-loss in my leverage ETF position and raising a yellow flag for most trades.

Honestly, fundamentals look intact, with good tailwinds going forward, but I’ll respect my risk control, nevertheless. So I triggered a stop-loss in NRGU and took the opportunity to cover the shorts in XRT and XHB.

Particularly about NRGU, even though fundamentals are solid, i) keep the risk control tight, and ii) 50% is a good gain.

I’m willing to rejoin the trade above $600/share.

Adding Leverage

Added US$80k in MELI (margin). Probably more changes in the next week.

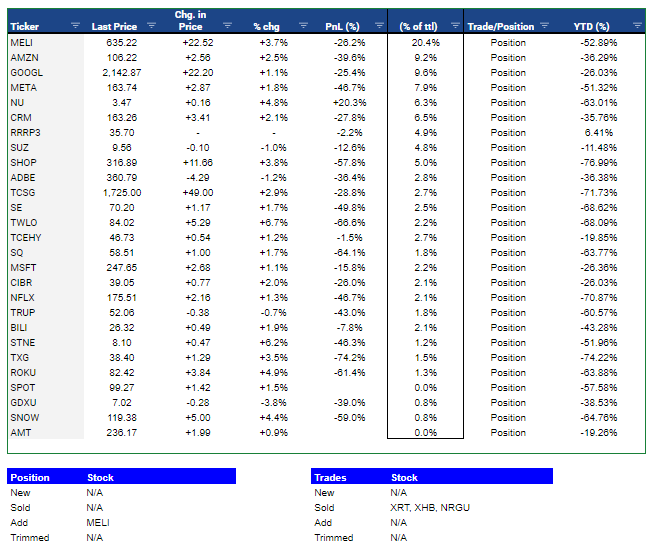

Portfolio

Position

Trading

It’s quite painful, but the Positions, mostly tech companies, are down 50% YTD, while the trades are up 20%. On the other hand, diversification proves its value once again.

Google Sheets is not returning all data for a few tickers, so rely mostly on money-weighted performance.

Spreadsheet

Updated on June 20th, at 9:18 pm.

Also, we recommend staying on the “DASHBOARD” tab if you just wish to see my positions. We intend to update the file weekly, so don’t worry about missing anything.

How are you dealing with the tax windfall from the positive trades in your PnL vs the markdown in your tech stocks?