Hi.

I want to write an update on PBR 0.00%↑ in today’s post. A few things first. Thanks for the feedback about Stone. It’s been great having discussions at such a high level. It keeps pushing my bar up.

I believe that many people already know this, but PBR is negotiating cheaper than ever, even than Russian O&G companies.

The company is a State-Owned Enterprise (SOE), which means that PBR is susceptible to external interference in its governance. Before talking about the numbers, let me explain why I’m not worried about exposure to an SOE company.

Interactive model at the bottom of the post.

In 2018, going over the factual allegations against the crimes inside PBR regarding a massive bid-rigging and bribery schemes by failing to implement adequate internal controls, something is interesting about the non-prosecution agreement (NPA).

Notably, neither the DOJ nor the SEC imposed an independent compliance monitor. The DOJ acknowledged that PBR is undertaking numerous compliance enhancements, yet this case would undoubtedly involve external monitoring in the US.

I believe the DOJ and the SEC were referring to a couple do decisions PBR made back then:

The company established a compliance division called the Division of Governance and Compliance that obligated PBR to review all the processes the company had;

PBR eliminated individual decision-making authority by implementing a four-eyes approval policy requiring supervisors' second review from different reporting lines for substantive decisions.

Under practical terms, PBR created an internal hedge, implying the people who approve any new contract with a supplier or customer or even hire a high-rank employee.

Before, if you had a director rank and would like to give your stupid nephew a job or hire a supplier company your wife owns, you needed nothing but a pen. Now, your nephew and your wife’s company go over an Integrity Background Check (BIC), with both reports going through an internal and external audit and, then, if they are approved, a second employee (same rank as yours) has to sign the contract with you.

There is a tremendous benefit to the company involving a second employee signing the contract and sharing legal responsibility. So I believe PBR was able to create some skin in the game. And, of course, I’m assuming that this director won’t get fired first.

Does it mean that PBR is uncorrupted? Of course, not. But things got more complicated. Second, internal controls prevent the company from interference from controlling shareholders? Nope, as we’ll see below.

Before moving on, why don’t you share the content with friends and colleagues : )

Recent history

Petrobras was founded in 1953, and since then, the company has had 39 CEOs. An average of almost two years for each CEO. Having changed its leadership so often, PBR is a company we can expect a shift in culture, strategy, credibility, investments, etc.

No wonder, eventually the controlling shareholder undermines PBR’s credibility, making sure that no long-term investor builds a robust position in the company. Understand, the influence of the controlling shareholder put at risk any long term strategy PBR announces.

Buying an SOE (State Owned Enterprise) is a decision that exposes you to changes in fuel pricing policy, as we saw from (2010 to 2014), and to pivotal strategic plans, such as the direction of the divestment plan.

From 2010 to 2014, with the Board of Directors (BOD) consent, PBR capped fuel prices in Brazil to avoid inflationary impacts. Consequently, PBR took losses above US$40bn, as they had to go to the international market to buy a more expensive product and sell in Brazil at lower prices.

In 2015, after Dilma’s impeachment, the company implemented a policy aligning its domestic prices with international benchmarks. However, in 2016 the new resolution of price parity was questioned with the truck driver’s strike that stopped Brazil for weeks.

PBR experienced another intervention, pushed to create a subsidize for diesel prices temporarily. Back then, the oil prices fell, and the strike was over.

In 2021, Mr. Roberto Castelo Branco, forme PBR’s CEO, was invited by the Mines and Energy Minister and Economy Miniter to give his opinion about fuel prices. He said that higher prices weren’t his problem, but President Bolsonaro disliked his answer, firing him.

On the following day, PBR announced a new meeting, and Mr. Castelo Branco was succeeded by Mr. Joaquim Silva e Luna, General from the Army and former Defence Minister and former Director of the Itaipu Binacional company.

A board meeting took place to analyze the request from the controlling shareholder to change Mr. Castelo Branco’s positBranco’she board to Mr. Luna.

A month later, a second meeting happened to analyze the approval for the CEO seat. Up to this point, the controlling shareholder had all the cards since they held 7 out of 11 board seats.

The only maneuver that upset BOD members could do was to evoke the right of not being re-elected to their positions. According to SOE federal law, the removal of any board member by the assembly can lead to the removal of all members, leading to the need for the placement of another assembly to re-elect new or the same board members.

The removal of Mr. Roberto da Cunha Castello Branco from the position of member of Petrobras Board of Directors resulted in the removal of the other seven (7) members of the Company’s Board of Directors elected by the multiple vote process in the Annual Meeting of the Company’s Shareholders of July 22, 2020.

Then, PBR hosted and ceremony where Mr. Luna took office as the new CEO. During the event, the new CEO, Chairman of BOD, and Mines and Energy Minister made speeches about PBR’s price policy continuity and no political interference.

As we saw in this section, political interference isn’t unusual in PBR, which has led to a massive turnover in senior management over the years. However, the operational prospects couldn’t be better.

Well, if you got this far, make sure to subscribe. Only this way, I know that you want to keep reading my stuff.

Strategic plan (2022-2026)

For those following PBR for a while, what a journey it’s been. Back in 2017, when the company announced its divestment program, close to being concluded.

Besides that, investors were unaware of the aftermath of this process, including Capex and Opex reduction, deleveraging, better governance, and focus on critical assets.

The plan recently announced implies a 100% dividend in 5 years! Really, who would imagine such a thing six years ago? So, yes, those were the highlight that caught my attention.

First, it’s important to highlight that finally, PBR updated its Brent curve (now to U$55) and USDBRL above 5.00. Even though they are behind the curve, this helps to show how cheap PBR is. Now, the highlights:

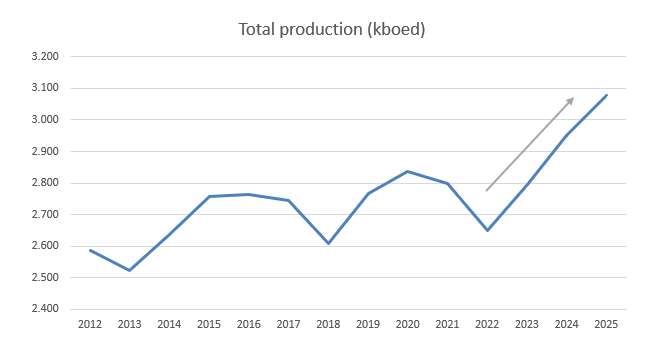

Increase in total Capex (from U$55b to U$68b) to back more substantial output curve towards the back-end. That means that in the near term, PBR will produce less Oil in the short-term to produce more looking forward;

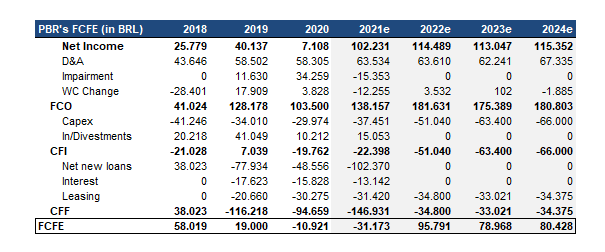

Updating FX and Brent prices, PBR updated its FCO from BRL120b to BRL155n, a sharp increase, but expected considering Brent’s level; It’s worth highlighting that I’m “estimating” Brent at U$80/bbl and USDBRL at 5,8. Considering these, I’d diverge from PBR’s estimates of BRL155bn in FCO to ~BRL180bn.

JUICY Dividends: PBR will start paying dividends on a quarterly based, with a U$4b minimum, payable only in years with Brent above U$40. The company may decide to pay dividends above its current policy (60%*(FCO-Capex)). As the gross debt target remained at U$65bn, my quick math suggests minimum cash of U$8/9bn versus an actual U$12b in cash. It Means PBR will pay juicy dividends for Christmas;

There is a tremendous upside risk for dividends in 2021 and 2022 (just looking at the curve). I know PBR is an SOE, but >20% dividend yield considering Brent at $55 sounds like a screaming buy.

What I did in the image above was consider PBR’s div. yield versus FCO using US$80/bbl for Brent instead of U$60/bbl. Real upside risk.

Ok. But how much risk is priced in that cant be offset with a 100% dividend in 5 years?

PBR operates majority stakes in two of the worlds’ largest profitable offshore oilfields discovered in recent years.

Governance has improved substantially in the past 5/7 years.

Gross debt has fallen more than 50% from the peak to under U$60bn. The gross debt was flexible to US$65bn, working as a cushion to lease impacts.

Friends of mine know how much I hate fucking multiples. However, I can find a way to prove AMC cheap using multiples if you wish. Here, money talks, bullshit walks.

Looking at my estimates above, here are a few takes. First, consider that PBR will not reinvest excess cash. Instead, the company will increase dividends; second, I flatted the most extended tails to be conservative.

If you want to take a better look at the valuation, check out PBR’s interactive model.

Password: PBR_Giro2022

Thanks for reading!

Disclosure: All posts on Giro’s Newsletter are for informational purposes only. This post is NOT a recommendation to buy or sell securities discussed. So please, do your work before investing/gambling your money.