Santander launches PIX Parcelado

What is it and what does it mean for banks/payment companies?

Hi

Santander (NYSE: BSBR, BVMF: SANB11) announced a new product, the "PIX Parcelado," a new solution for the Brazilian Instant Scheme ("PIX").

Within the Brazilian instant payment (IP) ecosystem, Banco Central do Brasil (BCB) created Pix, the Brazilian IP scheme that enables its users — people, companies, and governmental entities — to send or receive payment transfers in a few seconds at any time, including non-business days.

By transferring funds between transactional accounts — demand, savings, and prepaid payment accounts — Pix is a payment method that tends to have a lower acceptance cost because its framework works with few intermediaries.

Although Itaú (ITAUCARD) was selected to join the regulatory sandbox to develop PIX Parcelado, Santander Brasil is the first sizeable incumbent bank to do an extensive PIX Parcelado campaign.

Santander is merchandising the product on their website to boost new openings. The minimum installment payment is R$5 (US$1), the minimum purchase value is R$100 (US$20), the first installment is paid 59 days after purchase, and the product will function from midnight to 11 PM every day.

Though many people have been comparing the PIX Parcelado to crediário, the product is similar to a usual credit card transaction.

Crediário: installment plan, where you pay by something by making a series of small payments over a long time through bank slips ("Boletos"). In this sort of transaction, who owns the credit risk is the merchant.

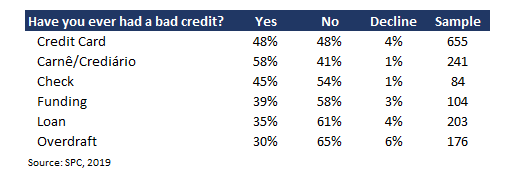

Although the Crediário is an excellent product for clients, it usually has a delinquency rate much higher than different products, so merchants avoid it.

Upon the purchase, depending on credit analysis, Santander decides on the client's available limit, the number of installments to be paid, and the interest charged (2,09% p.m. minimum). Unlike crediário, who takes the credit risk and evaluates it is Santander, not the merchant.

In my estimates, considering tax, insurance, and all expenses related to transactions, the minimum 2,09% p.m. actually is a 2,59% p.m. cost to the client, or 35,9% p.a.

Also, if the merchant sells the product through a Point-of-sale machine (POS), he'll have to pay a take rate to the acquirer/sub-acquirer for intermediating the service.

Honestly, how different is this from a traditional credit card transaction?

— Well, actually, there is a difference. Banks would not be dumb enough to invest in a new product in exchange for nothing.

To hire a PIX Parcelado, you DON'T have to own a credit card. Though credit cards have ~20% share on transactions, it has <2% share on financial volume.

Therefore, consumers with enough credit card limits have little incentive to use Santander's PIX Parcelado. For example, no interest is charged for credit card purchases if the client isn't delinquent, it is more widely accepted, and there are benefits (cashback, reward programs).

But Santander's product should have greater adherence for clients without a good credit score to own a credit card or for a purchase that exceeds their credit card limit, in my opinion.

Also, I don't think that Pix Scheme competes with $MA and $V. Those with enough credit card limits receive so much convenience using a credit card. It's a scale game, and both are really well-positioned.