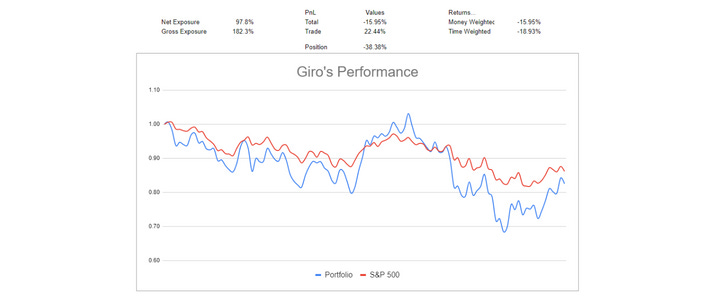

YTD Track Record

Short-Term Insights

From Previous Weeks

[Keep, May 2nd] I’m getting increasingly bull on Oil at the current prices. There is only a marginal sign of demand destruction, even though supply constraints have increased. We mentioned it in a Food for Thought edition, but releasing SPR inventory is stupid and non-sense. So instead, we proposed an alternative solution that would require support from the current administration. Unfortunately, our base case is that the current administration will let the market balance on demand destruction and, therefore, manufacturing job losses.

Bull, XLE @76.35 (+17.2%)[Keep, May 9th] Although I’m still tactically bearish on tech stocks, we anticipated most of MercadoLibre’s extraordinary earnings and added heavily to our position. So in relative terms, Meli should outperform tech stocks. In my personal account, however, the leverage is low.

Bull Ratio MELI / XLK @6.60 (-14.6%)[Keep, May 9th] Bull RRRP3 @44.00 (10.5%): I wanna keep it simple. I’m long RRRP, but not paying attention to EWZ anymore.

[Keep, May 22nd] We wrote about this trade in this Food for Thought edition, but it sounds good owning cyclical stocks vs. defensive. Since I found no ETF that matched the basked I used to trade, the closest one was the Value ETF (IWN). On the short side, a consumer staple is a straightforward call. So, the final trade is long IWN and short KXI. Sizing on this one was a bit tricky. On fundamental, the upside looks limited, though the technical sucks. However, we believe this earnings season may prove a catalyst for the trade, so we decided on a 10% exposure with an 8% stop loss.

Bull Ratio IWN/KXI @2.48 (2.9%)

Feedbacks

In our latest poll, almost 30% of the respondents asked for the portfolio images in the post. Apparently, Google Sheets isn’t a mobile friend application. For me, as long as it helps, it is fine.

Also, I’ll keep the spreadsheet. Since I coded it, there is no reason not to offer you both. So, I’m including the “Portfolio” section again.

Weekly Comments

“That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy . . . And you better brace yourself.” (Jamie Dimon, warning oil could reach $175/bbl)

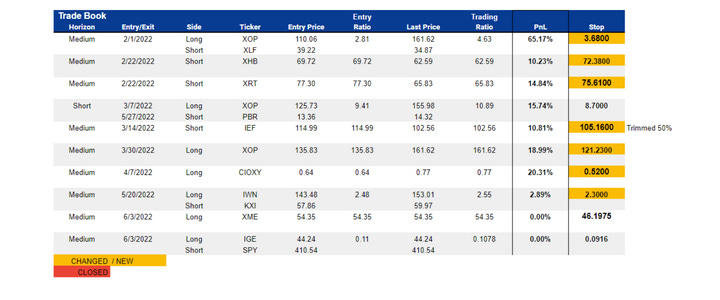

If you read our last Food for Thought edition yesterday, you may be wondering how to protect your money in the case that I’m right. On Friday, I opened a new trade long North American Natural Resources ($IGE), using as funding the S&P 500.

Since I don’t like having turnover in my Positions, and I don’t have much cash either, a long-short trade should do the job.

Remember, this is what I’m doing for myself. Many people would argue that if I had sold off my Positions and only traded, I’d be doing great.

This is partially true because it’s considered a concise window. One of the most valuable lessons I learned as an investor — not as a trader — is that you should avoid interrupting compounding.

I’ve made MUCH more money “doing nothing” than trading stocks. But, again, this is just a year of trading performance. I’m not telling you a bullshit story about how I make 25% per year in my trading book.

This is a 10% exposure trade

Chinese Stocks Under the Radar

I’ll add a couple of Chinese names to my Watchlist.

PDD - Side @Long; Trigger @55.70; stop @47.37

JD - Side @Long; Trigger @67.24; stop @54.36

Back to Metals

I entered again in the M&M trade.

XME - Side @Long; New @54.35; stop @46.20

I stopped the PBR.A/PBR.

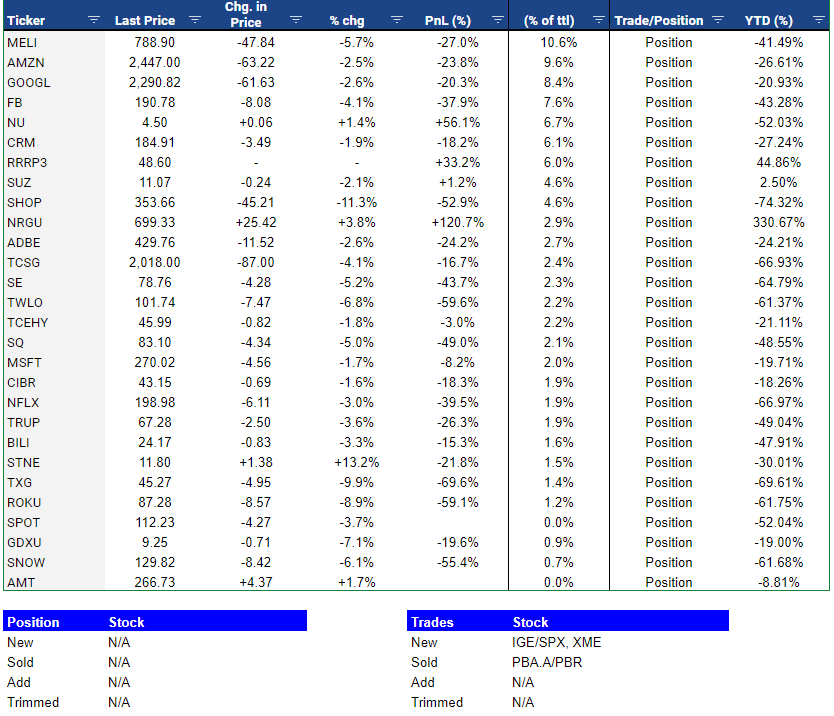

Portfolio

Position

Trading

Spreadsheet

Updated on June 6th, at 1:41 am.

Also, we recommend staying on the “DASHBOARD” tab if you just wish to see my positions. We intend to update the file weekly, so don’t worry about missing anything.

Hey Giro, i noticed the small position in BILI. Keen to get your thoughts on the thesis for this one. Quite an interesting company.